How CRM Components Impact Customer Loyalty: A Case from Bangladesh Banking Industry

Main Article Content

Abstract

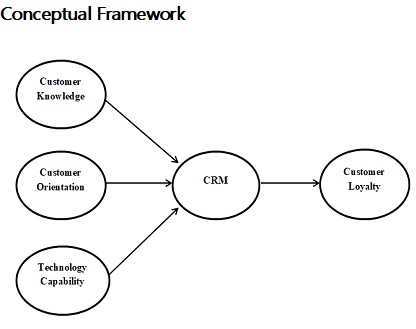

The purpose of this study is to determine the impact of customer relationship management (CRM) components on customer loyalty of a firm. The three components of CRM in this study are customer knowledge, customer orientation, and technology capability. A structured questionnaire with a 5-point Likert scale was used to gather the data by conducting a survey. The sample size is 200 and chosen on a convenient basis. Indicators were generated based on the literature review. Data were analyzed by using PLS 3.0 software. The key finding is that customer loyalty is negatively impacted by the CRM component, customer knowledge. On the other hand, the impacts of customer orientation and technology capability on customer loyalty have been found to be significant and profound. This study adds to the existing pool of knowledge on CRM components and customer loyalty from the perspective of the Bangladesh banking sector. The findings may facilitate bank officials and can be used as a strategic instrument for cultivating customer loyalty in the Bangladesh context.

Downloads

Article Details

Section

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish in this journal agree to the following terms:

- Authors retain copyright and grant the journal the right of first publication, with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (see The Effect of Open Access).

How to Cite

References

Al-Dmour, H., Algharabat, R., Khawaja, R. & Al-Dmour, R. (2019). Investigating the impact of ECRM success factors on business performance. Asia Pacific Journal of Marketing and Logistics, 31(1), 105-127. DOI: https://doi.org/10.1108/APJML-10-2017-0270

Alrubaiee, L. & Nazer, N. (2010). Investigate the Impact of Relationship Marketing Orientation on Customer Loyalty: The Customer's Perspective. International Journal of Marketing Studies, 2(1), 56-59. DOI: https://doi.org/10.5539/ijms.v2n1p155

Bang, J. (2005). Understanding customer relationship management from manager’s and customer’s perspective: Exploring the implications of CRM fit, market orientation, and market knowledge competence. Doctoral Thesis, University of Rhode Island.

Bhat, S.A. & Darzi, M.A. (2016). Customer relationship management: an approach to competitive advantage in the banking sector by exploring the mediational role of loyalty. International Journal of Bank Marketing, 34(2), 3-6. DOI: https://doi.org/10.1108/IJBM-11-2014-0160

Bhat, S.A., Darzi, M.A., & Parrey, S.H. (2018). Antecedents of Customer Loyalty in Banking Sector: A Mediational Study. The Journal for Decision Makers 43(2), 92–105. DOI: https://doi.org/10.1177/0256090918774697

Bickel, R. (2012). Multilevel analysis for applied research: It's just regression! London: Guilford Press.

Boulding, W., Staelin, R., Ehret, M., & Johnston, W. J. (2005). A customer relationship management roadmap: What is known, potential pitfalls, and where to go?. Journal of Marketing, 69(4), 155-166. DOI: https://doi.org/10.1509/jmkg.2005.69.4.155

Butler, S. (2000). Changing the Game: CRM in the E-World. Journal of Business Strategy, 21(2), 13–14. DOI: https://doi.org/10.1108/eb040067

Chen, I.J. & Popovich, K. (2003). Understanding customer relationship management (CRM) people, process and technology. Business Process Management Journal, 9(5), 672-688. DOI: https://doi.org/10.1108/14637150310496758

Chin, W. W. (1998). The partial least squares approach to structural equation modeling. Modern methods for business research, 295(2), 295-336.

Chin, W. W. (2010). How to write up and report PLS analyses. London: Springer.

Chin, W. W. & Newsted, P. R. (2003). A Partial Least Squares Latent Variable Modeling Approach For Measuring Interaction Effects: Results From A Monte Carlo Simulation Study And Electronic Mail Emotion/Adoption Study. Information Systems Research, 14(2), 189-217. DOI: https://doi.org/10.1287/isre.14.2.189.16018

Chuang, S.H. & Lin, H.N. (2013). The roles of infrastructure capability and customer orientation in enhancing customer-information quality in CRM systems: empirical evidence from Taiwan. International Journal of Information Management, 33(2), 271-281. DOI: https://doi.org/10.1016/j.ijinfomgt.2012.12.003

Cohen, J. (1988). Statistical power analysis for the behavioral sciences (2nd ed.). Hillsdale: Lawrence Erlbaum Associates.

Cox, D. R., & Hinkley, D. V. (1979). Theoretical statistics (2nd ed.). Florida: CRC Press. DOI: https://doi.org/10.1201/b14832

Day, G.S. (2000). Managing marketing relationships. Journal of the Academy of Marketing Science, 28(1), 24-30. DOI: https://doi.org/10.1177/0092070300281003

Day, G. S. (2003). Creating a Superior Customer-Relating Capability. Sloan Management Review, 44(3), 77-83.

Day, R.L. (1984). Modeling choices among alternative responses to dissatisfaction. Advances in Consumer Research, 11th Association for Consumer Research, Provo, UT.

Deshpande, R., Farley, J.U. & Webster, F.E. (1993). Corporate culture, customer orientation, and innovativeness in Japanese firms: a quadrat analysis. Journal of Marketing, 57(1), 23–37. DOI: https://doi.org/10.1177/002224299305700102

Doney, P.M. & Cannon, J.P. (1997). An examination of the nature of trust in buyer-seller relationships. Journal of Marketing, 61(2), 35-51.

Donnelly, M. (2009). Building Customer Loyalty: A Customer Experience-Based Approach in a Tourism Context. Ph. D. Thesis, Waterford Institute of Technology.

Dous, M., Kolbe, L., Salomann, H., & Brenner, W. (2005). KM capabilities in CRM: Making knowledge for, from and about customers' work. In Proceedings of eleventh America’s conference on information systems Omaha, NE, USA

Dubey, N.K. & Sangle, P. (2018). Customer perception of CRM implementation in the banking context: Scale development and validation. Journal of Advances in Management Research, 12(3), 56-60.

Durkin, M. & Howcroft, B. (2003). Relationship marketing in the banking sector: the impact of new technologies. Marketing Intelligence & Planning, 21(1), 61-71. DOI: https://doi.org/10.1108/02634500310458162

Dyer, N.A. (1998). What’s in a relationship other than relations?. Insurance Brokers Monthly & Insurance Adviser, 48(7), 16-17.

Falk, R. F., & Miller, N. B. (1992). A primer for soft modeling. Akron: Akron Press.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of marketing research, 4(8), 39-50. DOI: https://doi.org/10.1177/002224378101800104

Foss, B., & Stone, M. (2002). CRM in financial services: a practical guide to making customer relationship management work. London: Kogan Page.

Geisser, S. (1974). A predictive approach to the random effect model. Biometrika, 61(1), 101-107. DOI: https://doi.org/10.1093/biomet/61.1.101

Hair, J. J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2010). Multivariate Data Analysis (7th Ed.). Upper Saddle River, New Jersey: Prentice Hall.

Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2014). A Primer on partial least squares structural equation modeling (PLS-SEM) (1st Ed.). Los Angeles: Sage

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice, 19(2), 139-152. DOI: https://doi.org/10.2753/MTP1069-6679190202

Hair, J.F., Black, W.C., Babin, B. & Anderson, R. (2016). Multivariate Data Analysis. London: Cengage Learning

Hasan, L. M., Zgair, L. A., Ngotoye, A. A., Hussain, H. N., & Najmuldeen, C. (2015). A review of the factors that influence the adoption of cloud computing by small and medium enterprises. Scholars Journal of Economics, Business and Management, 2(1), 842-848.

Henseler, J., Ringle, C. M., & Sinkovies, R. R. (2009). The use of partial least squares path modeling in international marketing. Emerald Group Publishing Limited, 6(2), 277-319). DOI: https://doi.org/10.1108/S1474-7979(2009)0000020014

Henseler, J. (2012). PLS-MGA: A non-parametric approach to partial least squares-based multi-group analysis. Berlin Heidelberg: Springer.

Hussain, I., Hussain, M., Hussain, S., & Sajid, M.A. (2009). Customer Relationship Management: Strategies and Practices in Selected Banks of Pakistan. International Review of Business Research Papers, 5(6), 117-132.

Idzikowskiadam, A., Kurylo, P., Cyganiuk, J., & Ryczko, M. (2019). Customer Relationship Management (CRM) - Philosophy and its Significance for the Enterprise. System Safety: Human, Technical Facility and Environment, 1(1), 1004-1011. DOI: https://doi.org/10.2478/czoto-2019-0127

Järvinen, R.A. (2014). Consumer trust in banking relationships in Europe. International Journal of Bank Marketing, 32(6), 551-566. DOI: https://doi.org/10.1108/IJBM-08-2013-0086

Jayachandran, S., Sharma, S., Kaufman, P. & Raman, P. (2005). The role of relational information processes and technology use in customer relationship management. Journal of Marketing, 69(4), 177-192. DOI: https://doi.org/10.1509/jmkg.2005.69.4.177

Khodakarami, F. & Chan, Y.E. (2014). Exploring the role of customer relationship management (CRM) systems in customer knowledge creation. Information & Management, 51(1), 27-42. DOI: https://doi.org/10.1016/j.im.2013.09.001

Kincaid, J.W. (2003). Customer Relationship Management: Getting it Right!. New Jersey: Prentice-Hall.

Kocoglu, D. & Kirmaci, S. (2012). Customer Relationship Management and Customer Loyalty: A Survey in the Sector of Banking. International Journal of Business and Social Science, 3(3), 282-291.

Kolodinsky, J. M., Hogarth, J. M., & Hilgert, M. A. (2004). The adoption of electronic banking technologies by US consumers. International Journal of Bank Marketing, 22(4), 238-259. DOI: https://doi.org/10.1108/02652320410542536

Lin, Su. & Chien. (2005). A knowledge-enabled procedure for customer relationship management. Industrial Marketing Management, 35(6), 446 – 456.

Lindgreen, A., & Antioco, M. (2005). Customer relationship management: The case of a European bank. Marketing Intelligence & Planning, 23(2), 136-154 DOI: https://doi.org/10.1108/02634500510589903

Lovelock, C. H. (1993). Classifying services to gain strategic marketing insights. Journal of Marketing, 47(3), 9-20 DOI: https://doi.org/10.1177/002224298304700303

Mavrides, D. (2004). The performance of the Japanese banking sector. Journal of Intellectual Capital, 5(1), 92-115. DOI: https://doi.org/10.1108/14691930410512941

Narang, Y., Narang, A. & Nigam, S. (2011). Gaining the Competitive Edge through CRM- A Study on Private Sector Banks. International Journal of Research in Finance and Marketing, 1(3), 12-30.

Narver, J. C., & Slater, S.F. (1990). The Effect of a Market Orientation on Business Profitability. Journal of Marketing, 54(10), 20-35. DOI: https://doi.org/10.1177/002224299005400403

Nguyen, B., & Mutum, D. (2012). A review of customer relationship management: successes, advance, pitfalls, and futures. Journal of Business Process Management, 18(3), 2-4. DOI: https://doi.org/10.1108/14637151211232614

Nunnally, J., & Bernstein, I. (1978). Psychometric theory (2nd ed.). New York: McGraw-Hill.

Nunnally, J., & Bernstein, I. (1994). Psychometric Theory (3rd ed.). New York: McGraw-Hill.

Oliver, R.L., 1999.Whence consumer loyalty? J.Mark, 63(2), 33–44. DOI: https://doi.org/10.2307/1252099

Pandyanayak, M. & Venkateshwarlu, H. (2019), Customer Relationship Management (CRM) Practices in Select Public and Private Sector Banks in Hyderabad City. Global Journal of Management and Business Research: E-Marketing, 19(3), 78-80.

Parasuraman, A., Zeithaml, V. A., & Berry, L. L. (1985). A conceptual model of service quality and its implications for future research. Journal of Marketing, 49(4), 41-50. DOI: https://doi.org/10.1177/002224298504900403

Peppard, J. (2000). Customer relationship management (CRM) in financial services. European Management Journal, 18(3), 312-327. DOI: https://doi.org/10.1016/S0263-2373(00)00013-X

Pousa, C. & Mathieu, A. (2014). Boosting customer orientation through coaching: a Canadian study. International Journal of Bank Marketing, 32(1), 60 – 81. DOI: https://doi.org/10.1108/IJBM-04-2013-0031

Pullman, M., & Gross, M. (2004). The ability of Experience Design Elements to Elicit Emotions and Loyalty behaviors. Decision Sciences Journal, 35(3), 551 578. DOI: https://doi.org/10.1111/j.0011-7315.2004.02611.x

Rapp, A., Trainor, K.J. & Agnihotri, R. (2010). Performance implications of customer-linking capabilities: examining the complementary role of customer orientation and CRM technology. Journal of Business Research, 63(11), 1229-1236. DOI: https://doi.org/10.1016/j.jbusres.2009.11.002

Rigdon, E.E. (2012). Rethinking partial least squares path modeling: in praise of simple methods. Long Range Planning, 45(5/6), 341-358. DOI: https://doi.org/10.1016/j.lrp.2012.09.010

Roscoe, D. (2003). So what is the future for CRM?. Journal of Customer Management, 5(7), 42-43.

Rowley, J. (2002). Eight questions for customer knowledge management in e‐business. Journal of Knowledge Management, 6(5), 500-511. DOI: https://doi.org/10.1108/13673270210450441

Sampaio, F., Mogollon, H., & Rodrigues, A.G. (2019). The relationship between market orientation, customer loyalty and business performance: A sample from the Western Europe hotel industry. Tourism and Hospitality Research, 1(2), 1-12.

Sarstedt, M., Ringle, C.M., Henseler, J. & Hair, J.F. (2014). On the emancipation of PLS-SEM: a commentary on Rigdon (2012). Long Range Planning, 47(3), 154-160. DOI: https://doi.org/10.1016/j.lrp.2014.02.007

Sayani, H. (2015). Customer satisfaction and loyalty in the United Arab Emirates banking industry. International Journal of Bank Marketing, 33(3), 351-375. DOI: https://doi.org/10.1108/IJBM-12-2013-0148

Sharma, S. & Goyal, D.P. (2011). Critical success factors for CRM implementation: a study on Indian banks. Information Intelligence, Systems, Technology and Management, Communications in Computer and Information Science, 141(2), 32-40. DOI: https://doi.org/10.1007/978-3-642-19423-8_4

Siddiqi, T., Khan, K.A., & Sharna, S.M. (2018), Impact Of Customer Relationship Management on Customer Loyalty: Evidence from Bangladesh’s Banking Industry. International Journal of Business, Economics, and Law, 15(5), 78-89.

Sin, L.Y.M., Tse, A.C.B., & Yim, F.H.K. (2005). CRM: conceptualization and scale development. European Journal of Marketing, 39(11/12), 1264-1290. DOI: https://doi.org/10.1108/03090560510623253

Sirdeshmukh, D., Singh, J., & Sabol, B. (2002). Consumer trust, value, and loyalty in relational exchanges. Journal of Marketing, 66(1), 15-37. DOI: https://doi.org/10.1509/jmkg.66.1.15.18449

Sivaraks, P., Krairit, D. & Tang, J.C. (2011). Effects of e-CRM on the customer–bank relationship quality and outcomes: the case of Thailand. The Journal of High Technology Management Research, 22(2), 141-157. DOI: https://doi.org/10.1016/j.hitech.2011.09.006

Smith, H.A. & McKeen, J.D. (2005). Developments in practice xviii - customer knowledge management: adding value for our customers. Communications of the Association for Information Systems, 16(1), 744-755. DOI: https://doi.org/10.17705/1CAIS.01636

Stefanou, Constantinos, Sarmaniotis, C., & Stafyla, A. (2003). CRM and Customer-Centric Knowledge Management: An Empirical Research. Business Process Management Journal, 9(5), 617–634. DOI: https://doi.org/10.1108/14637150310496721

Stone, M. (1974). Cross-validatory choice and assessment of statistical predictions. Journal of the Royal Statistical Society. Series B (Methodological), 36(2), 111-147. DOI: https://doi.org/10.1111/j.2517-6161.1974.tb00994.x

Swift, R. (2001). Accelerating customer relationships using CRM and relationship technologies. New Jersey, USA: Prentice Hall.

Tacq, J. J., & Tacq, J. (1997). Multivariate analysis techniques in social science research: From problem to analysis (1st ed.). London: Sage Publications Limited.

Tseng, L. (2019). How customer orientation leads to customer satisfaction: Mediating mechanisms of service workers’ etiquette and creativity. International Journal of Bank Marketing, 37(1), 210-225. DOI: https://doi.org/10.1108/IJBM-10-2017-0222

Uppal, R.K. (2008), Customer Relationship Management in the Indian Banking Industry. New Delhi: New Century Publications.

Vinzi, V. E., Chin, W. W., Henseler, J., & Wang, H. (2010). Perspectives on partial least squares. In Handbook of partial least squares. Berlin: Springer.

Wang, Y. G., & Feng, H. (2012). Customer relationship management capabilities: measurement, antecedents, and consequences. Management Decision, 50(1), 115-129. DOI: https://doi.org/10.1108/00251741211194903

Wilson, B. J. (2011). An investigation into three consumer constructs: explaining the nature of relations influencing brand relationship quality. Doctor of Philosophy, RMIT University.

Wu & L, Lu. (2012). The relationship between CRM, RM, and business performance: A study of the hotel industry in Taiwan. International Journal of Hospitality Management, 31(1), 276-285. DOI: https://doi.org/10.1016/j.ijhm.2011.06.012

Xu, M. & Walton, J. (2006). Gaining customer knowledge through analytical CRM. Industrial Management and Data Systems, 105(7), 955-971. DOI: https://doi.org/10.1108/02635570510616139

Yim, F.H., Anderson, R.E., & Swaminathan, S. (2004). Customer relationship management: its dimensions and effect on customer outcomes. Journal of Personal Selling and Sales Management, 24(4), 263-78.

Zadeh, M. H., Ghoryshian, S. H. & Amir M. D. (2013). Impact of customer relationship management (CRM) on marketing performance: A Case Study in Mellat Bank of Mazandaran Province. Journal of Natural and Social Science, 2(3), 2612-1619

Zineldin, M., 2005. Theory of loyalty: CRM, quality and retention. J. Consumer. Mark. 23(7), 430–437. DOI: https://doi.org/10.1108/07363760610712975